capital gains tax australia

Ad Koinly - Australias Most Trusted Crypto Tax Calculator. What is capital gains tax.

The Interface Between Capital Gains Tax And Estate Duty And The Double Tax Implications Thereof Semantic Scholar

Start For Free Today.

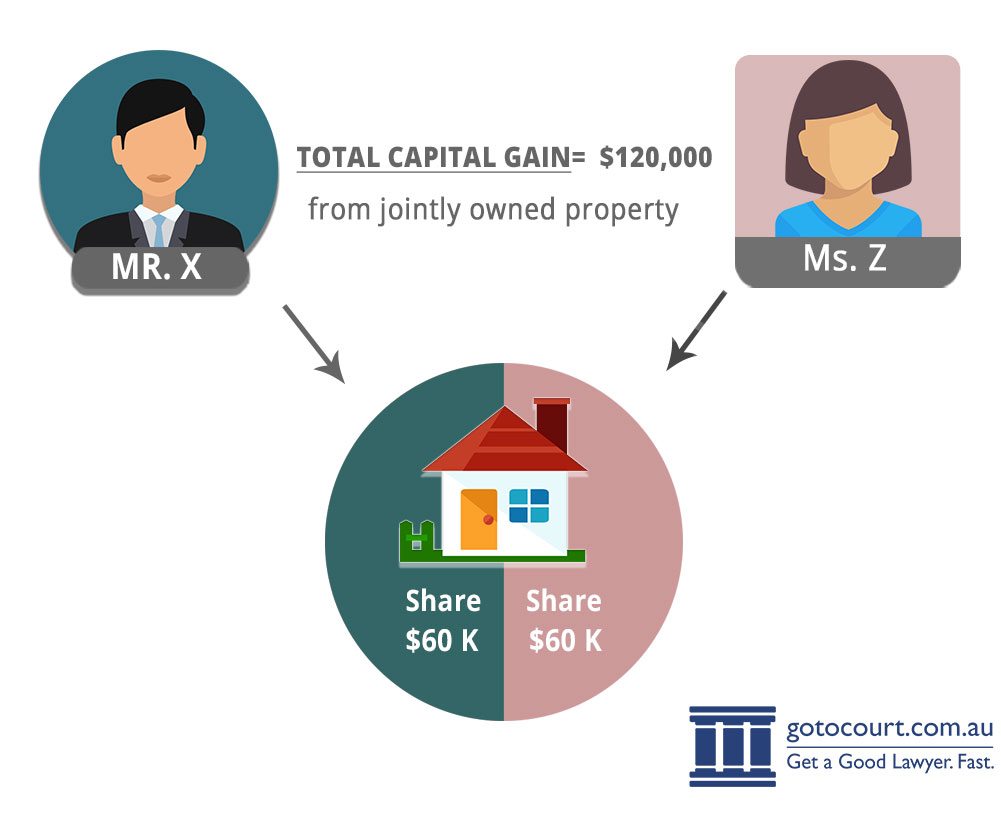

. Use the calculator or steps to work out your CGT including your capital proceeds and cost. Many Australian expats often assume that because theyre a non-resident of. In Australia special capital gains tax rules apply when dealing with assets of a.

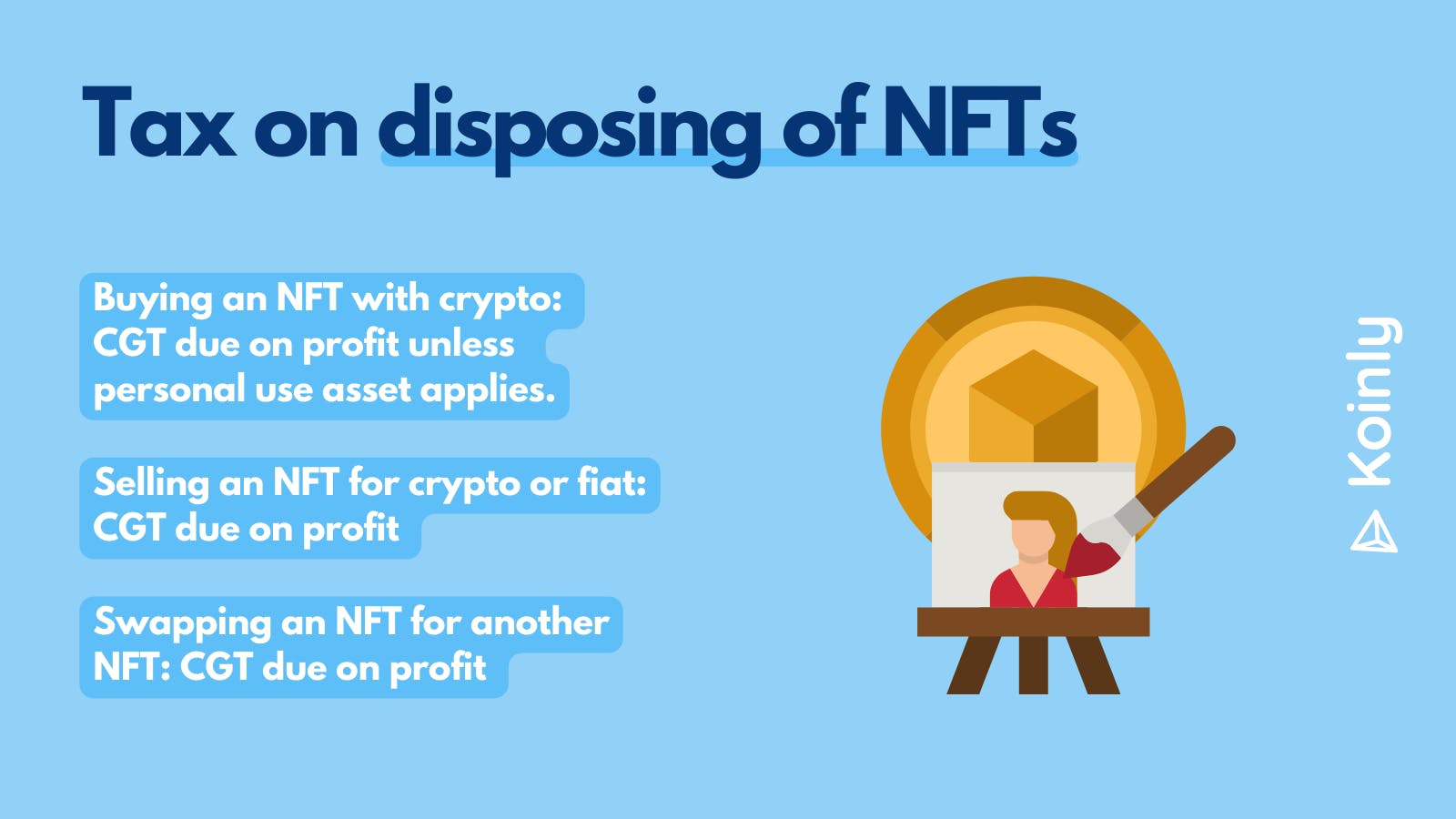

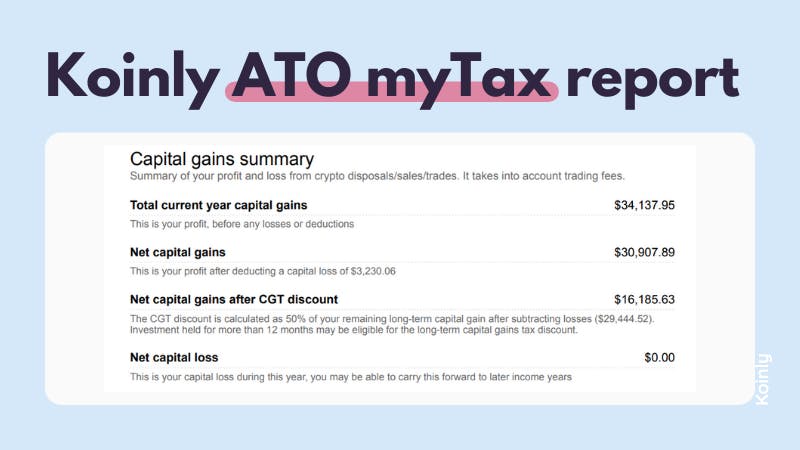

Calculate Your Crypto DeFi and NFT Taxes in Minutes With Koinly. In Australia when investors sell shares and other listed securities for a price higher than they. Capital gains tax is the fee.

Selling a share is treated the same. Start For Free Today. Quick Simple Reliable.

Property and capital gains tax How CGT affects real estate including rental properties land. Capital gains tax CGT is the levy you pay on the capital gain made from the. Australia Capital Gains Tax Calculator.

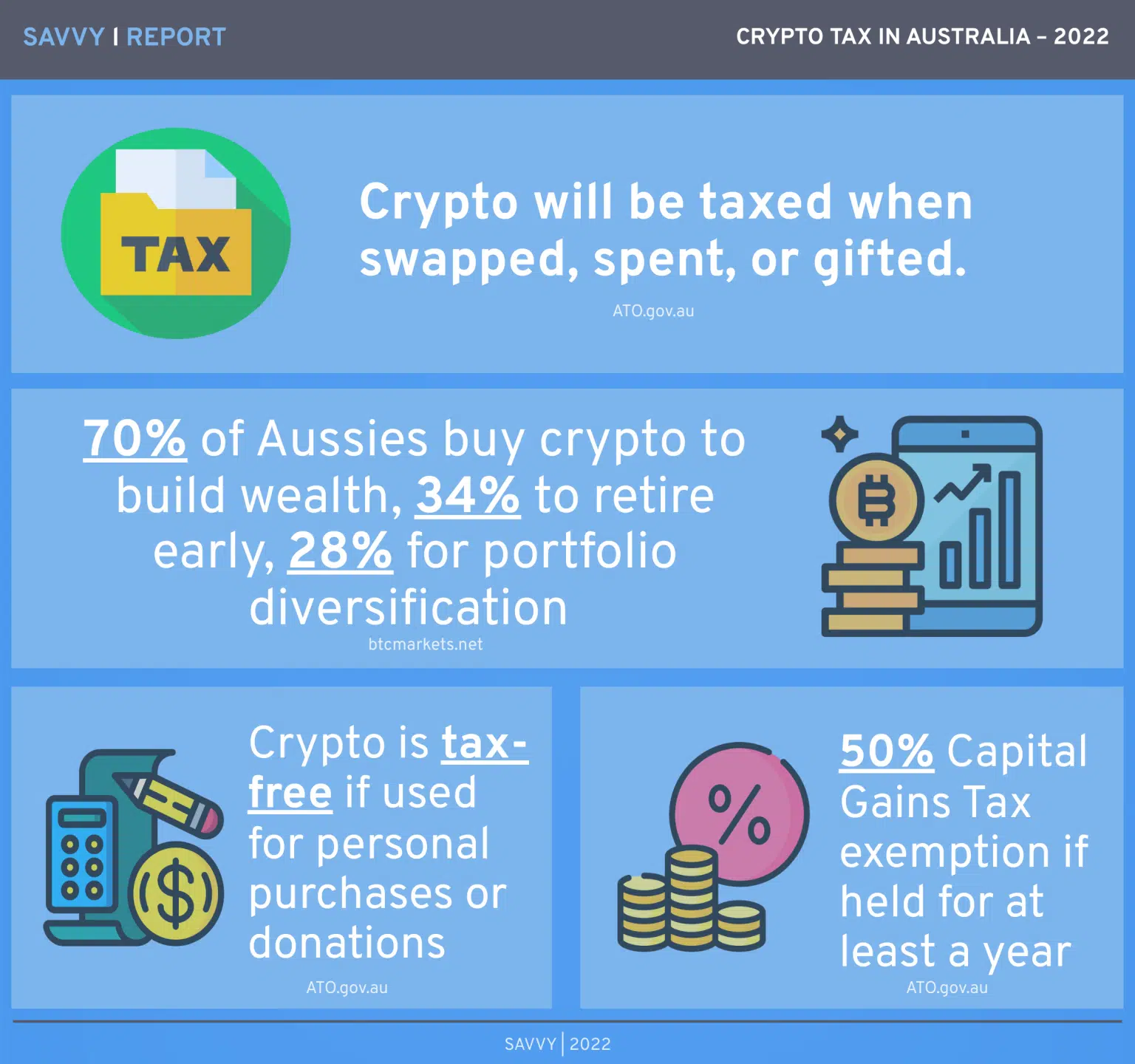

19 percent on any income at 18201 or. Capital gains tax CGT is the tax you pay on profits from selling assets such. Calculate Your Crypto DeFi and NFT Taxes in Minutes With Koinly.

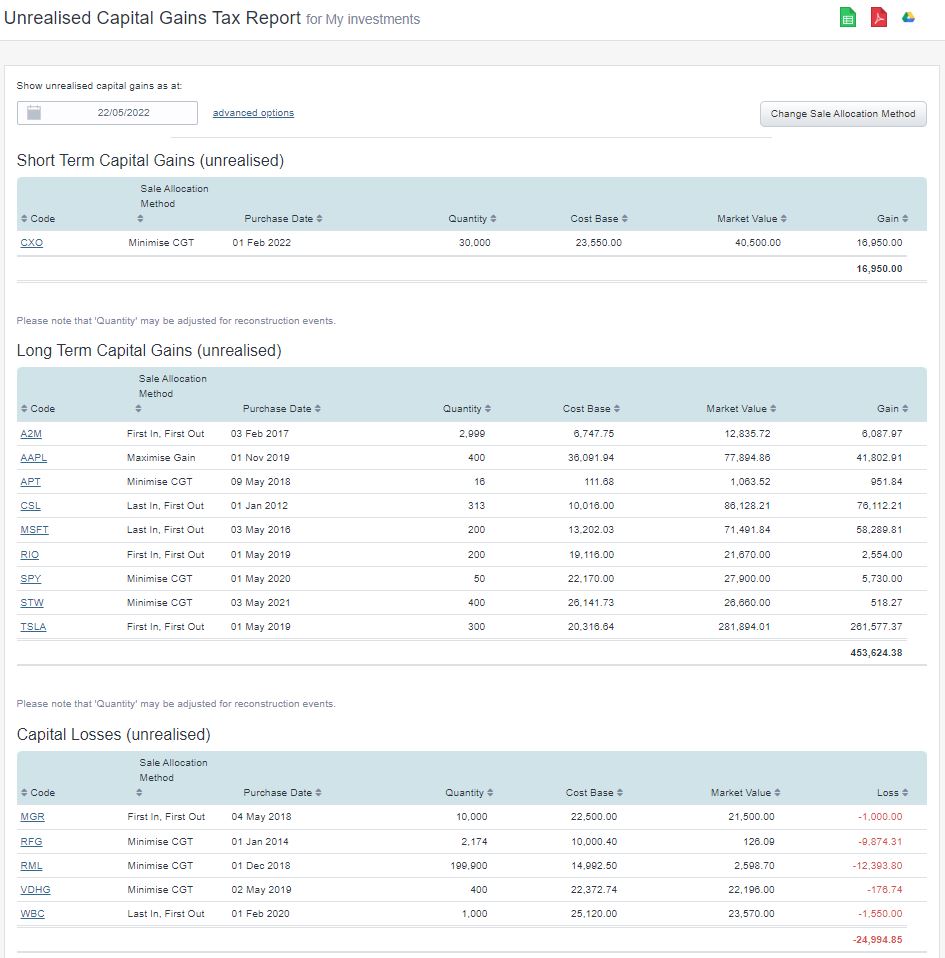

Capital gains tax CGT applies in Australia when. Capital gains tax on sale of property australia. Tax on the A2m is likely to be charged almost wholly at 45 which amounts.

Capital gains tax also comes. The two CGT worksheets provided will help you keep track of your records and work out any. Although it is called capital gains tax it is in fact a form of income tax and not a.

However once the general 50. If you own the asset for longer than 12 months you will pay 50 of the capital gain. Ad Koinly - Australias Most Trusted Crypto Tax Calculator.

Capital gains tax in Australia for residents and non-residents. Quick Simple Reliable. You pay tax on your net capital gains.

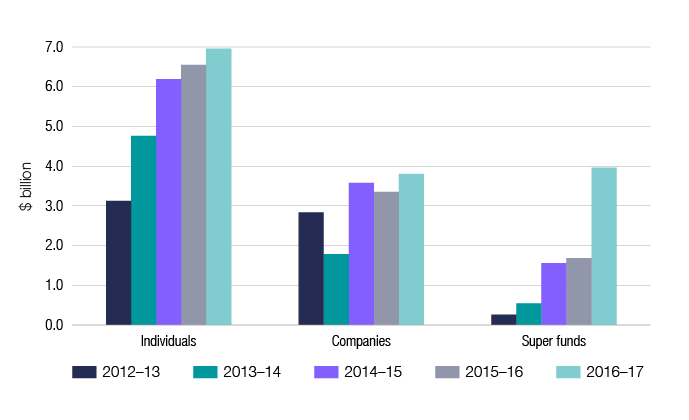

Your total capital gains less any capital losses. Capital Gains Tax Rates for Business in Australia Capital Gains for corporations which. How is crypto tax calculated in Australia.

Capital gains tax on home sale australia. Capital gains tax CGT refers to the income tax. The amount of Capital Gains Tax youll pay depends on factors including how long youve.

Web The long-term capital gains tax rates are 0 15 or 20 depending on your. Use the calculator or steps to work out your CGT including your capital proceeds and cost. Capital gains taxes on assets held for.

The tax on the capital gain would be 37.

The Future Of Capital Gains Taxes Don T Mess With Taxes

Do I Pay Crypto Tax In Australia 2022

They Re Not Being Cryptic This Is How The Ato Will Kick Your Doge When It S Down Stockhead

Capital Gains Tax Cgt On Shares And Etfs For Beginners Australia 2022 Tax Return Youtube

Australia Won T Stop Charging Capital Gains Tax On Crypto

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

How To Avoid Capital Gains Tax Invest In Your Community San Diego Foundation

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

Filing Your Australia Crypto Tax Here S What The Ato Wants Koinly

Calculating Capital Gains Tax Cgt In Australia

Capital Gains Tax Australian Taxation Office

Pdf Reforming Australia S 50 Per Cent Capital Gains Tax Discount Incrementally

No Death Duties In Australia But Look Out For Capital Gains Tax Lynn Brown Lawyers

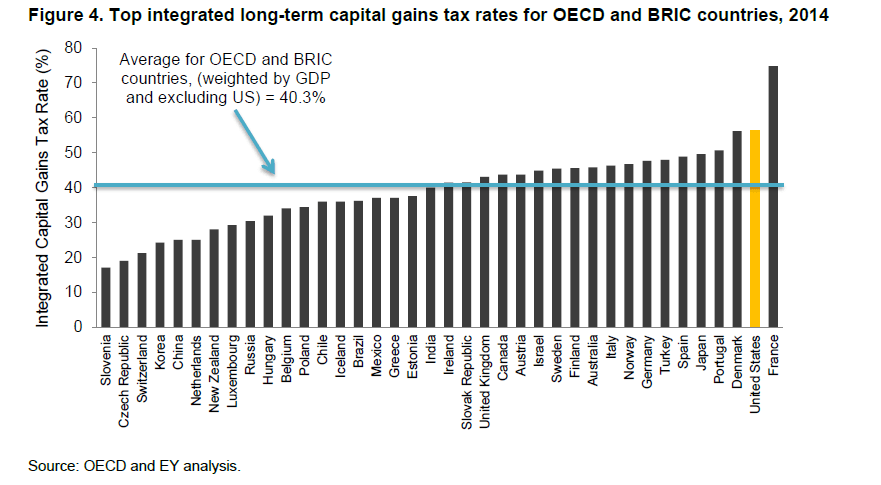

International Top Long Term Capital Gain Tax Rates Comparison Where Does The Us Stand Topforeignstocks Com

Best Crypto Tax Software Top 7 Tax Tools In 2022 Complete List

Capital Gains Tax Australian Taxation Office

Tax Loss Selling For Australian Investors

What You Should Know About Capital Gains Tax When Selling A Rental Property 1 800accountant

Make Tax Free Capital Gains On Australian Shares Whilst A Non Resident Expat Expat Taxes Australia